Terence and his wife jointly bought their matrimonial home at the end of 2006. The estimated market price of their resale condominium has since risen by more than 186% (source: SRX January 2024 update). This is an average growth of 10.9% per year over 17 years! Would you be thrilled if your asset can achieve such an astounding appreciation? This is the main reason why homeowners upgrade their properties: to grow their wealth and retirement fund.

Raymond and his wife upgraded from a 4-room HDB flat to a brand new 3-bedroom condo. They were able to upgrade to a condo without even touching their cash savings. Watch the video and hear from Raymond what motivated him to take that leap of faith.

Wow! 5-room HDB flat in Bedok South with less than

54 years of lease remaining sold for $715,000!

Despite all the concerns about property cooling measures, high mortgage interest rates and the state of the economy, we sold a HDB 5-room flat in Bedok South Ave 2 in December 2023 with a remaining lease of only 53 years and 4 months for an astounding $715,000! Click here to learn more.

Can You Buy First Then Sell Your Flat Later Without Having to Pay ABSD?

It is Possible for New Executive Condo.

James & Pearline were contemplating to renovate their HDB 5-room flat in Bedok South with a remaining lease of 56 years when they contacted us after seeing our ad. After two zoom meetings and detailed financial calculations, they agreed the money for the renovation could be better spent upgrading to an EC with more potential for capital gain. Opting for the Deferred Payment Scheme, James & Pearline were able to book a brand new 4-bedroom EC at Parc Central Residences while they continue to live in their flat, with the mortgage payments only starting upon the EC obtaining the Temporary Occupation Permit (TOP). Also, since it is a new EC, no Additional Buyer's Stamp Duty (ABSD) is payable as they would need to sell their flat. Contact us to find out if an EC or a Condo is a better option for you.

Click Here to Sign Up for a FREE 60-min Consultation

Is It Really Possible to Upgrade from HDB to Condo with ZERO Cash from Your Savings?

Yes, You Can!

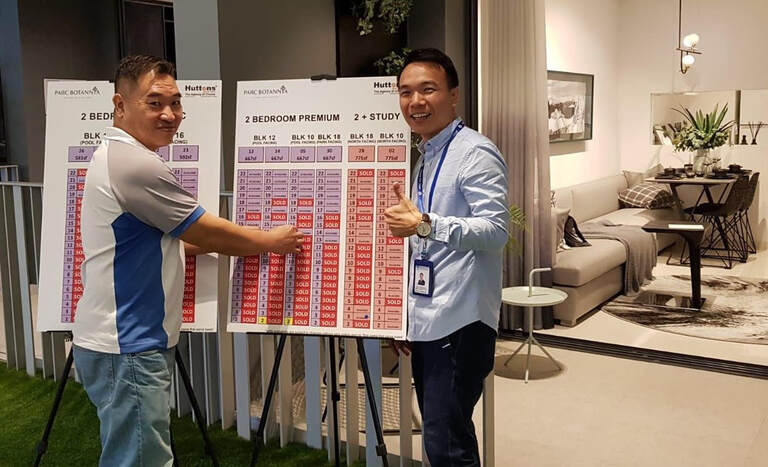

Fellow realtor Raymond Ng and his wife Celine upgraded from a 4-room HDB flat in Woodlands to a 3-bedroom condominium in Parc Botannia. And they did it without touching their cash savings!

We have helped many homeowners upgrade from HDB to condo or EC with little or even zero cash from their existing savings.

Do You Know?

We have helped many homeowners upgrade from HDB to condo or EC with little or even zero cash from their existing savings.

Do You Know?

- If your monthly household income is $8,000 or more, it may be possible to upgrade from HDB to Condo with ZERO Cash from your current savings.

- You may even be able to set aside a Reserved Fund of $150,000 or even more for rainy days.

- For some HDB homeowners, it may even be possible to safely own 2 Private Properties.

Click Here to Sign Up for a FREE 60-min Consultation

Three Common Myths

- Only very wealthy people can afford to own private properties. This is far from the truth. Many of our clients who upgrade to ECs or condos are middle or upper-middle income HDB flat owners who have the aspiration to improve their lives and do better for their families and themselves.

- If I sell my HDB flat and upgrade to an EC or condo, I will not be able to own a HDB flat again. Not true. In fact, it is very common for homeowners to right-size from a condo to a HDB flat in order to cash out and enjoy a worry-free retirement.

- It is too risky to take a property loan from a bank to purchase an EC or condo. Most people would not be able to purchase an EC or condo without taking a loan from a financial institution. When you pay the monthly loan instalment, one part goes to reduce the principle amount borrowed and the other part to pay the bank as interest. Treat it as a form of "disciplined, forced savings". You reap the generous reward when your property makes good capital gain and you cash out and take profit. To ascertain if you can upgrade safely, meticulous financial calculations will be carried out.

Is Your Current Property a Good Hedge Against Inflation?

Are you feeling the pinch from the rising cost of living in Singapore? The coffee you drink in the morning, your favorite chicken rice and the gas you fill at the pump... prices have all shot up! Inflation is real and without careful planning, it will eat up your purchasing power and even ruin your retirement plans.

Do you know that owning a private property can be a good hedge against inflation in land-scarce Singapore? This is one main reason why many HDB homeowners are upgrading to ECs or condos. Climbing up the property ladder helps you grow your property asset, enabling you to cash out later to supplement your retirement savings.

A sobering fact...

If you wish to retire at 62 with just a modest monthly allowance of $2,500 till you are 80 years old, you would need a whopping $540,000!!!

Are you able to save $540,000 just by working hard? And we haven't even factored in inflation!

Do you know that owning a private property can be a good hedge against inflation in land-scarce Singapore? This is one main reason why many HDB homeowners are upgrading to ECs or condos. Climbing up the property ladder helps you grow your property asset, enabling you to cash out later to supplement your retirement savings.

A sobering fact...

If you wish to retire at 62 with just a modest monthly allowance of $2,500 till you are 80 years old, you would need a whopping $540,000!!!

Are you able to save $540,000 just by working hard? And we haven't even factored in inflation!

Don't Just Work Hard. Make Your Property Work Harder for You.

Would you like to have enough savings and the option to:

- Retire early?

- Pay for your children's further education?

- Go on dream vacations?

- Build a stream of passive income so you can choose to work less?

If your household income is more than S$8,000 per month, it may be possible for you to upgrade your property.

If you could upgrade safely and grow your wealth and retirement fund, what is stopping you?

Sign up and connect with us for a FREE 60-minute consultation

In this one hour, we’ll:

If you could upgrade safely and grow your wealth and retirement fund, what is stopping you?

Sign up and connect with us for a FREE 60-minute consultation

In this one hour, we’ll:

- Listen and understand your needs, wants and concerns and take your questions

- Show you the relevant market information and data and how they may affect you

- Share with you how we’ve helped many of our clients upgrade safely

- Gather information from you to help assess if property upgrading is indeed suitable for you

- Arrange another meeting to share our findings and recommendations

Click Here to Sign Up for a FREE 60-min Consultation

3 Reasons Why You Should Engage Us

- We've helped many HDB homeowners market and sell their flats and then guide them to safely upgrade from HDB to condo or EC, including both new-launch and resale properties. We have the necessary experience and you can trust that you are in steady hands.

- We seek to understand your needs first and will go through with you the necessary checks to ensure property upgrading is indeed safe for you before we proceed.

- We do not charge you any fee to help you purchase a new or resale condo or EC. It, therefore, makes absolute sense for you to engage an experienced, reliable and trustworthy realtor to safeguard your interest.

How We've Helped Our Clients

A detailed financial analysis and stress test was done for the Tans that helped them upgrade from HDB to condo with ZERO cash from their savings. A reassuring safety net was also created to cover for about 5 years of monthly mortgage payments should the Tans not work. Learn more about how the Tans did it.

Our thorough analyses done for Mr & Mrs Tan showed they would be able to pay the monthly mortgage installments for their new condo for about 7 years even if they were to be retrenched or lose their jobs!

Upgrading can be worry-free if you get the right advice. Learn more about Mr & Mrs Tan's upgrading journey.

Upgrading can be worry-free if you get the right advice. Learn more about Mr & Mrs Tan's upgrading journey.

Firdaus and Siti initially thought upgrading was beyond their means. But after some thorough fact-finding and detailed financial calculations, we determined they could safely upgrade to a new Executive Condominium. We are glad to help make their dreams come true. Learn more about their upgrading story.

Civil servant P.H. Ng had seen many of his friends profited by investing in multiple properties and he was also keen to invest in a new private condo to fund his retirement. The financial stress tests conducted for Mr Ng illustrated that even if the rental market were to remain soft, Mr Ng could still pay the monthly mortgage instalments for his new condo for about 98 months and without touching his personal cash savings! Learn more about Mr Ng's property investment journey.

Mr Goh and his wife, who are both Singaporeans, do not wish to sell their jointly-owned condominium in the West Coast area. Terence suggested to Mr Goh to do a property “part-share” with his wife. It enabled Mrs Goh to invest in a 3-bedroom condo in Queens Peak without having to pay the Additional Buyer’s Stamp Duty (ABSD). Learn more about Mr & Mrs Goh's property investment strategy.

"You and your entire team have given us a very professional impression… Your articulate presentation and detailed work helped us buy our dream home,”

~ Mr. & Mrs. Lu Changzhi (above picture with Raymond)

~ Mr. & Mrs. Lu Changzhi (above picture with Raymond)

"Throughout the process, Terence was patient, he understood my needs and gave me sound and valuable advice. With his help, I was able to smoothly upgrade from a 3-room HDB flat to a 2-bedroom private condominium. I highly recommend his service!"

~ Ms. Janice Wong

~ Ms. Janice Wong